𝐁𝐚𝐬𝐢𝐜 𝐑𝐞𝐚𝐥 𝐄𝐬𝐭𝐚𝐭𝐞 𝐓𝐞𝐫𝐦𝐬 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 𝐚 𝐏𝐫𝐨𝐩𝐞𝐫𝐭𝐲!

Before you begin the buying process, you should have a basic awareness of important real estate principles. Here are some basic real estate terms you need to know. Back to homepage

1. Ready For Occupancy (RFO)

The property/unit you are purchasing is already livable. Thus, the buyer needs to pay spot cash downpayment (usually 10% – 20% of the total contract price) so he/she can move in, considering the bank loan has been approved and ready for a take-out loan.

2. Preselling

The property is not yet built, or the construction has just been started. Thus, the buyer only needs to pay the monthly equity (downpayment which is divided into a number of months, mostly equivalent to the turnover date of the property). Preselling is much cheaper than RFO.

3. Equity/Downpayment

This is the amount that represents the difference between the selling price and loanable amount.

4. Transfer charges

This is the amount the buyer will need to pay for the processing of the condo or lot title before the turnover of his/her unit.

A LESSON FROM A FORGOTTEN KEY

As my wife stepped out of the car to withdraw some cash from the bank, a sudden beeping sound startled me. At first, I thought it was just the usual seatbelt warning. But then, I glanced at the dashboard display and saw the message: “Key not in vehicle.” Back to homepage

“This is strange,” I thought. “Maybe the car isn’t recognizing the key.” I reached for the spot where I usually place it, but it wasn’t there. I searched everywhere in the car—nothing. That’s when it hit me: I had left the key at home.

Thankfully, I hadn’t turned off the engine yet, or it would’ve been a real disaster. The situation left me scratching my head because I’ve always made it a point to check for the key before leaving the house. But no matter how careful we are, moments like this remind us that we are bound to forget. Back to homepage

This experience got me thinking: the tendency to forget isn’t always a bad thing. It’s part of how we’re wired, and we can use it to our advantage. Just as we forget where we put a key, we can also choose to let go of things that weigh us down—anger, envy, hatred, sorrowful memories, and other negative emotions.

On the flip side, God encourages us to remember the things that matter. For example, He set aside the Sabbath as a time to reconnect with Him—a reminder to focus on what truly nourishes our souls.

This moment of forgetfulness taught me a lesson: while forgetting is natural, it’s what we choose to let go of and what we choose to hold on to that shapes us. Let’s forget the burdens and remember the blessings.

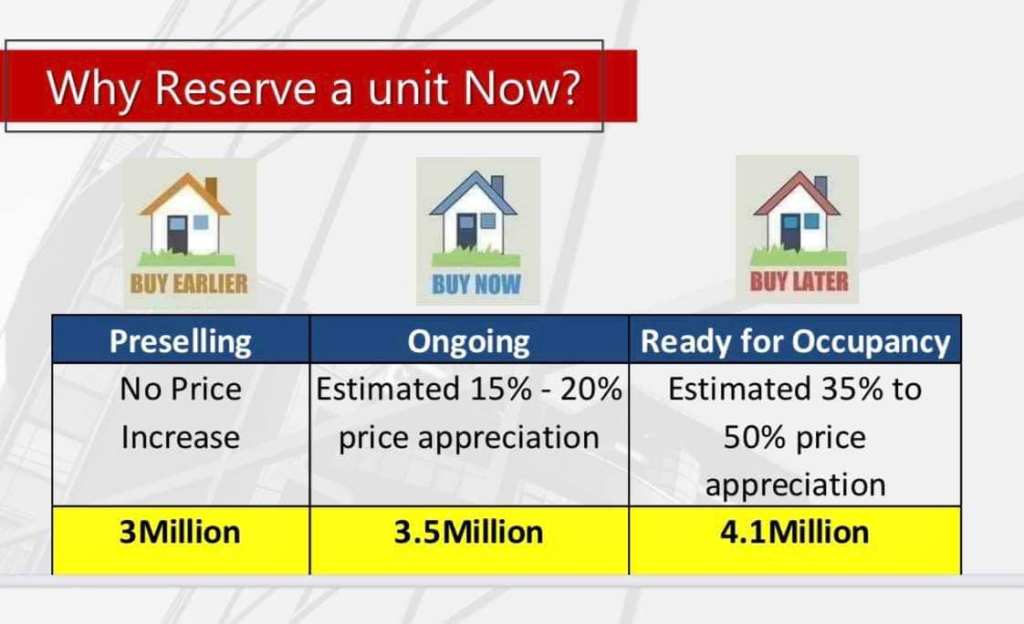

𝐏𝐑𝐈𝐂𝐄 𝐍𝐄𝐕𝐄𝐑 𝐂𝐎𝐍𝐓𝐑𝐀𝐃𝐈𝐂𝐓 𝐓𝐈𝐌𝐄 𝐈𝐍 𝐑𝐄𝐀𝐋 𝐄𝐒𝐓𝐀𝐓𝐄

The real estate industry has consistently shown a trend of rising property prices, a phenomenon driven by various market dynamics and consumer behaviors. This increase is particularly evident as properties move from the pre-selling stage to ready-for-occupancy (RFO), making timing a crucial consideration for both investors and end-users.

The Pre-Selling Advantage

In the pre-selling stage, developers offer units at significantly lower prices. This phase is a marketing strategy designed to generate capital for construction and attract early investors. Buyers benefit from discounted prices and flexible payment terms, making pre-selling an appealing option for those seeking affordability and long-term gains. Back to homepage

Factors Contributing to Price Increases

Several factors contribute to the continuous rise in real estate prices as projects transition from pre-selling to RFO:

- Market Demand

High demand for quality residential and commercial spaces drives up prices. As completion nears, properties become more attractive to buyers who prefer move-in-ready options, further inflating prices. - Construction and Development Costs

Developers face escalating costs for materials, labor, and regulatory compliance. These expenses are factored into property prices, especially as projects near completion. - Appreciation of Value

Properties tend to appreciate in value due to improved infrastructure, economic growth in the area, and increasing desirability of the location. This natural appreciation is reflected in higher RFO prices. - Limited Availability

As a project nears completion, the inventory of available units diminishes. The scarcity effect leads to competitive pricing, with developers capitalizing on high demand for the remaining units. - Enhanced Features and Amenities

Completed projects showcase their full range of amenities, community features, and finished aesthetics, which command a premium price compared to pre-construction plans.

Implications for Buyers and Investors

- For Investors: The price surge from pre-selling to RFO offers an opportunity for capital appreciation. Those who purchase early can enjoy significant returns on investment (ROI) if they decide to resell or lease out the property.

- For End-Users: While pre-selling offers affordability, RFO properties provide the advantage of immediate occupancy. However, buyers should be prepared to pay a higher price for this convenience.

Key Takeaway

The continuous increase in property prices highlights the importance of strategic planning when investing in real estate. Buyers who capitalize on pre-selling opportunities can benefit from lower prices and higher future value, while those seeking ready-for-occupancy units must weigh the cost against the immediate benefits of ownership.

As the real estate market evolves, understanding these trends can help buyers and investors make informed decisions, ensuring maximum value for their investments.

Be Cautious with the Term “CLEAN TITLE”

A property can only be considered as having a “clean title” if the following conditions are met:

- The Registered Owners

- All individuals listed as owners on the title are still alive and capable of signing the necessary documents.

- No Disputes on the Title

- The title is free from any disputes or claims, as verified through the most recent Certified True Copy of the title.

- Note: Not all disputes or encumbrances are indicated on the original title. This makes it essential to obtain the latest Certified True Copy from the proper registry.

- Real Estate Taxes

- All real estate taxes must be fully paid and up-to-date. Always request the latest Real Estate Tax Clearance.

- For Married Owners (Post-1987)

- If the title owner is married, the property is considered conjugal, even if only one spouse is named on the title. Both spouses must sign the sale documents.

- If the property owner has passed away, the heirs must file and settle the estate taxes before the property can be considered “clean.”

- Estate Tax Compliance

- If the estate tax (using BIR Form 1801) for properties of deceased owners has not been paid, the title is not “clean.”

- Estate tax is different from the annual real estate tax. You only pay estate tax when the owner listed on the title has passed away. Penalties for late filing can be significant.

Take these steps to ensure the title of a property is truly “clean” before proceeding with any transaction.

COST OF TRANSFER OF TITLE

Understanding the Cost of Transfer of Title

Transferring the title of a property in the Philippines is an essential step in the process of acquiring real estate. Whether you’re a first-time buyer or a seasoned investor, knowing the costs involved is crucial to avoid any surprises down the road. In this guide, we’ll break down the various expenses you can expect and offer tips on how to navigate the process smoothly.

What is Title Transfer?

Title transfer is the legal process of changing the ownership of a property from the seller to the buyer. This process ensures that the buyer’s name is officially recorded on the title, making them the legal owner. It involves several steps, including paying necessary taxes, securing documents, and registering the title with the appropriate government offices.

The Breakdown of Costs

Here’s a closer look at the costs associated with transferring a title in the Philippines:

- Capital Gains Tax (CGT):

- Rate: 6% of the property’s selling price, fair market value, or zonal value—whichever is highest.

- Who Pays: Typically, the seller is responsible for this tax. However, some contracts may state that the buyer pays it.

- Documentary Stamp Tax (DST):

- Rate: 1.5% of the property’s selling price, fair market value, or zonal value—whichever is highest.

- Who Pays: The buyer usually shoulders this cost.

- Transfer Tax:

- Rate: Varies by location, typically 0.5% to 0.75% of the selling price, fair market value, or zonal value—whichever is highest.

- Who Pays: The buyer pays the transfer tax.

- Registration Fee:

- Rate: Based on a sliding scale, depending on the property’s selling price. It generally ranges from 0.25% to 0.5%.

- Who Pays: The buyer.

- Notarial Fee:

- Rate: Around 1% to 2% of the property’s selling price, but this can be negotiated.

- Who Pays: The buyer usually pays this fee.

- Miscellaneous Fees:

- This includes fees for securing documents such as the tax clearance, certification of title, and other administrative expenses. These costs can vary but typically amount to a few thousand pesos.

Example Calculation

Let’s say you’re purchasing a property valued at PHP 3,000,000. Here’s a rough estimate of what you might expect to pay:

- Capital Gains Tax: PHP 180,000 (6% of PHP 3,000,000)

- Documentary Stamp Tax: PHP 45,000 (1.5% of PHP 3,000,000)

- Transfer Tax: PHP 15,000 (0.5% of PHP 3,000,000)

- Registration Fee: PHP 7,500 (0.25% of PHP 3,000,000)

- Notarial Fee: PHP 30,000 (1% of PHP 3,000,000)

Total Estimated Cost: PHP 277,500

Tips for a Smooth Title Transfer Process

- Double-Check the Property’s Documentation: Ensure that all necessary documents are in order before starting the transfer process. This includes the deed of sale, the latest tax declaration, and a copy of the title.

- Work with a Professional: Hiring a real estate lawyer or a licensed broker can help you navigate the legal intricacies and avoid potential pitfalls.

- Budget for Additional Expenses: Always set aside a little extra to cover unforeseen costs that may arise during the transfer process.

- Be Aware of Deadlines: Pay attention to the deadlines for tax payments and document submissions to avoid penalties.

Transferring a property title in the Philippines involves various costs, but with careful planning and knowledge, you can ensure a hassle-free experience. Understanding these expenses upfront allows you to budget effectively and makes the journey to owning your dream property much smoother.

Whether you’re buying a new home or investing in real estate, being well-informed about the title transfer process will empower you to make confident decisions and protect your investment.

CAPITAL GAINS TAX

Capital Gains Tax (CGT) is a type of tax imposed on the profit or gain arising from the sale or disposition of capital assets, such as real estate properties or stocks. When you sell a property or any other asset for more than what you originally paid for it, you make a profit, and the government taxes a portion of that profit.

Here’s a simple breakdown of how it works:

Sale of Property: Let’s say you bought a piece of land or a house at a certain price.

Increase in Value: Over time, the value of your property might increase due to factors like market demand, development in the area, or inflation.

Selling at a Higher Price: If you decide to sell the property at a price higher than what you paid for it, you’ll make a profit.

Capital Gains Tax: The government then imposes a tax on that profit, known as Capital Gains Tax. This tax is usually a percentage of the profit you made from the sale.

Payment: When you sell the property, you’re required to pay the Capital Gains Tax to the Bureau of Internal Revenue (BIR) within a certain period from the date of sale.

GOOD DEBT VS BAD DEBT 😎

Is borrowing money ever a good idea? 🤔 Let’s talk about it!

Taking on debt can be a slippery slope. It’s crucial to think twice before diving into loans, especially if it’s driven by impulse or stretches beyond our financial comfort zone.

However, not all debt is created equal. There are certain types that, when managed wisely, can actually work in your favor over time.

Let’s break it down into the good and the not-so-good:

GOOD DEBT 🌟

Investment Loans: Financing for assets like a home or education that can appreciate in value or generate income.

Business Loans: Funding for a venture with potential returns that exceed the cost of borrowing.

Strategic Investments: Using debt to leverage high-yield opportunities, like real estate or stocks.

BAD DEBT 🚫

Credit Card Splurges: Borrowing for non-essential purchases that quickly lose value.

Payday Loans: Short-term, high-interest debt that can trap you in a cycle of repayment.

Unplanned Borrowing: Taking on loans without a clear plan for repayment or financial benefit.

Remember, it’s all about being smart with your money. Debt can either be a tool for growth or a burden, so choose wisely! What’s your take on borrowing responsibly? Let’s chat! 🌱 #FinancialWellness #MoneyTalks #DebtWisdom

BIR raises VAT exemption on sale of house and lot to P3.6 million!

BY ALEJANDRO MAÑALAC JANUARY 18,2024

Bureau of Internal Revenue Commissioner Romeo D. Lumagui Jr has issued Revenue Regulations No. 1-2024 which increased, for value-added tax (VAT) exemption purposes, the selling price threshold of the sale of house and lot, and other residential dwelling from P3,199,200.00 to P3,600,000.00.

The adjustment was made by virtue of Section 109 (P) of the National Internal Revenue Code which mandates that every 3 years the subject amount should be adjusted to its present value using the consumer price index as published by the Philippine Statistics Authority.

Advertisement

“This timely increase in VAT exemption shows our commitment to excellent taxpayer service. This increase in the selling price threshold, for VAT exemption purposes, of the sale of house and lot, and other residential dwelling from P3,199,200.00 to P3,600,000.00 gives testament to the BIR’s improved and updated services,” Lumagui said.

The BIR said it would focus on its pillar of excellent taxpayer service this year.

President Ferdinand R. Marcos Jr. recently signed the landmark Ease of Paying Taxes Act, paving the way for a more modern tax system, with the ultimate goal of helping taxpayers in their tax obligations.

The subject revenue regulation also shows the government’s commitment to a just and service-oriented taxation in the Philippines.

THE TIMELESS WISDOM OF REAL ESTATE INVESTMENT

Are you contemplating the right time to dive into the world of real estate investment? Let me share a timeless piece of advice with you: “Don’t wait to buy real estate, buy real estate and wait.” This mantra has stood the test of time, echoing the wisdom of seasoned investors who understand the power of strategic property acquisition. [Back to homepage]

In a world of ever-changing markets and economic uncertainties, real estate remains a stalwart investment choice. Here’s why you should consider taking the plunge sooner rather than later:

Appreciation Over Time:

Real estate has consistently demonstrated the potential for long-term appreciation. While the value of other assets may fluctuate, well-chosen properties tend to appreciate over time. By making your investment today, you position yourself to benefit from future increases in property values.

Build Equity with Time:

Every mortgage payment you make isn’t just an expense – it’s a step towards building equity in your property. Unlike renting, where your monthly payments contribute solely to your landlord’s equity, owning real estate allows you to accumulate wealth over time.

Diversification of Portfolio:

A well-balanced investment portfolio includes a mix of assets, and real estate provides a tangible and stable foundation. Diversifying your investments with real estate can help mitigate risks and enhance the overall resilience of your financial portfolio.

Steady Rental Income:

If you choose to lease your property, you open up an additional income stream through rental payments. Real estate can provide a consistent and reliable source of passive income, offering financial stability and security.

Tax Advantages:

Real estate ownership brings about various tax benefits. Mortgage interest deductions, property tax deductions, and depreciation allowances are just a few of the ways real estate can help optimize your tax position.

Remember, successful real estate investment requires careful consideration and research. Identify emerging markets, understand the local economic landscape, and choose properties that align with your financial goals.

In conclusion, the adage “Don’t wait to buy real estate, buy real estate and wait” encapsulates the enduring wisdom of real estate investment. Instead of waiting on the sidelines, seize the opportunity to invest in real estate today and let time work its magic. Your future self will thank you for building a solid foundation for financial success.

5 REASONS WHY OFWs SHOULD INVEST IN PRE-SELLING HOMES

5 REASONS WHY OFWS SHOULD INVEST IN PRE- SELLING HOMES!

Affordable

Pre-selling units are more affordable compared to the regular ready-for-occupancy homes. OFWs can save money because of the low introductory price. Pre-selling properties are usually 30 to 50% cheaper than a finished one. Developers even offer discounts, a reduced down payment rate, and flexible payment schemes. Whether it is a townhouse or a condo unit, OFWs will find it easier to fulfill the payment because of affordability.

Appreciation of Value

The value of a property that was initially sold as pre-sale appreciates over a period of time after its construction. More so, when the community where it belongs to prospers and becomes more developed, its value will further increase. However, OFWs should seriously consider the location for it significantly plays a role when it comes to the worth of a property.

Potential Income-Generator

OFWs can potentially generate income even when they are not in the country once the property is already finished. They can opt to rent it out. That way, there would be a constant source of income that would help them save more money. They can also sell the home once the construction is done and invest in another pre-selling property. This cycle when ingeniously established encourages a pattern that helps generate income effortlessly. It can be helpful for OFWs who no longer want to work overseas.

Security

A sense of security is felt by OFWs when they buy a property. Pre-selling homes also give that feeling of anticipation because of the waiting period that is always worth it. Gone are the days when it takes a lot of effort just to find the home that would best cater to the needs of homeseekers. Nowadays, everyone can just access the internet and search for homes or even ask real estate professionals. OFWs are a part of those homeseekers who want to own a home that would meet all of their needs. Once they get a hold of that key to their new home, financial and even personal securities are guaranteed. Pre-selling properties can provide that feeling of assurance and anticipation to OFWs anytime.

Personal Satisfaction

The purchase of a pre-selling property usually gives everyone a fair chance to choose their ideal location. For a pre-selling condominium unit, OFWs can select which floor they prefer. But more than the luxury of choosing the best spot, they can take advantage of premium amenities that make the purchase of the property, even more, worth it. They can pick a unit that is strategically located nearby the pool area and playground, or the topmost floor to have the best view of the neighborhood. When they transfer, they can finally enjoy a relaxed lifestyle after years of hard work.

OFWs and pre-selling properties match perfectly. The important thing that they need to find out now is where the ideal location for their investment will be. Call us now!

Contact:

Gedion Padilla, Jr.

- Real Estate Salesperson

- PRC ACCREDITED and DHSUD REGISTERED

- Contact # 0906-242-8575 | 0947-856-2521

- Website: http://www.gedionpadilla.com

REAL ESTATE PROPERTIES APPRECIATE OVER TIME😍😲

The inherent nature of real estate properties is their tendency to appreciate over time. Therefore, postponing your investment translates to paying an implicit cost, in the form of price increments, for the delay.

By securing a unit now, you can benefit from the potential appreciation in value that real estate properties typically experience. As the market progresses, demand for desirable properties often increases, leading to an upward trajectory in their prices. This trend is driven by various factors such as population growth, urban development, and limited land availability. Consequently, the longer you wait to invest, the more you are likely to pay for the same property, as its value continues to rise. Back to homepage

By acting promptly, you can capitalize on the potential growth of your investment. Real estate, historically, has proven to be a reliable and robust asset class, offering long-term stability and potential returns. By reserving a unit now, you position yourself to take advantage of future market appreciation, ensuring that your investment not only maintains its value but potentially yields substantial gains.

Reserving a unit early grants you the opportunity to select from a wider range of options. As time progresses, the availability of prime properties may become limited, leaving you with fewer choices. By securing a unit now, you can take your pick from a broader selection, ensuring that you find a property that aligns with your preferences and investment goals.

Additionally, reserving a unit in the present allows you to take advantage of favorable financing options. Interest rates can fluctuate over time, and by acting promptly, you can secure a mortgage at a lower rate, potentially saving you a significant amount of money over the course of your investment.

Lastly, reserving a unit in the real estate market now is a prudent decision. By doing so, you position yourself to benefit from the potential appreciation in property values, avoid paying higher prices due to future market trends, and secure a property that suits your needs and aspirations. Act decisively, and you can maximize the growth and profitability of your real estate investment.

FOREIGNERS CAN OWN A CONDO IN THE PHILIPPINES

Escape to a tropical haven and discover the lucrative potential of owning a condominium in the Philippines! With open arms, the country invites foreign investors to seize a remarkable opportunity for portfolio diversification or indulge in a luxurious second home amidst paradise. Embrace the allure of the Philippines, where your dreams of owning a slice of heaven can become a reality. Experience the perfect blend of stunning natural beauty, vibrant culture, and unparalleled investment prospects. Don’t miss out on this captivating chance to elevate your lifestyle and expand your horizons. Invest in a Philippine condo today! 🌴💼💫

THE HIGHEST INTEREST RATE IN REAL ESTATE

In real estate, waiting is the highest interest rate. This is because the real estate market is dynamic, and prices can change rapidly based on several factors such as demand, supply, and economic conditions. As such, delaying your decision to invest in a property can lead to an increase in its price, which can ultimately cost you a significant amount of money. Back to homepage

One notable example of this is the price of properties located near the city. These properties are often in high demand due to their proximity to important amenities such as schools, hospitals, shopping centers, and job opportunities. As a result, their prices tend to increase over time, making them more expensive to purchase in the future.

However, buying earlier before the property is fully developed can save you a lot of money. During the pre-construction phase, developers often offer properties at lower prices to attract buyers. As an early investor, you can take advantage of these lower prices and potentially save a significant amount of money.

Additionally, buying early can provide you with the opportunity to customize the property to your liking. This may not be possible with an already-built property, where you have to accept the layout and features as they are. By customizing the property during the pre-construction phase, you can make sure that it meets your specific needs and preferences. Back to homepage

Furthermore, investing early can be a smart long-term investment strategy. As the area develops, the demand for properties in that location may increase, leading to an appreciation in their value. By investing early, you can potentially benefit from this appreciation and make a significant return on your investment.

In conclusion, waiting is the highest interest rate in real estate. Properties located near the city tend to increase in price over time, making it essential to invest early to save money. Buying during the pre-construction phase can provide you with the opportunity to customize the property and potentially benefit from appreciation in its value over time.

WHY THE LION IS CONSIDERED KING OF THE JUNGLE?

SECRET OF WINNERS

In the jungle:

1. The Elephant is the biggest;

2. The Giraffe is the tallest;

3. The Fox is the wisest; and

4. The Cheetah is the fastest;

Yet, the Lion is the KING of the jungle even without ANY of these qualities. (Back to homepage)

Why?

Because:

1. The Lion is courageous, is bold, walks with confidence, dares anything and is never afraid.

2. The Lion believes it is unstoppable.

3. The Lion is a risk taker.

4. The Lion believes any animal is food for him.

5. The Lion believes any opportunity is worth giving a trial and never lets it slip from its hands.

So…

1. You don’t need to be the fastest.

2. You don’t need to be the wisest.

3. You don’t need to be the smartest.

4. You don’t need to be the most brilliant.

5. All you need is courage

6. All you need is the will to try.

7. All you need is the faith to believe it is possible.

8. All you need is to believe in yourself, that you can do it.!!

The Lion sleeps for 20 hours & works for 4 hours & yet eats meat.

But the elephant works for 24 hours & eats grass.

Your life’s strategy matters most in your approach to circumstances & situations for you to be a champion or winner always.

Stay in Lion’s mood! That’s the mood for winners.

Did You Know?

- 𝗖𝗲𝗯𝘂 𝗖𝗶𝘁𝘆 ↦ Oldest City in the Philippines

- 𝗗𝗮𝘃𝗮𝗼 𝗖𝗶𝘁𝘆 ↦ Largest City in the Philippines

- 𝗧𝗮𝗴𝘂𝗺 ↦ Music Capital of the South

- 𝗦𝗮𝗺𝗮𝗹 ↦ Phil. Island Garden City

- 𝗗𝗮𝘃𝗮𝗼 𝗱𝗲𝗹 𝗡𝗼𝗿𝘁𝗲 ↦ Banana Capital

- 𝗠𝗮𝘁𝗶 ↦ Coconut City of the South

- 𝗗𝗶𝗴𝗼𝘀 ↦ Clay Capital of Mindanao

- 𝗠𝗮𝗹𝗶𝘁𝗮 ↦ Banana Capital of Davao

- 𝗞𝗶𝗱𝗮𝗽𝗮𝘄𝗮𝗻 ↦ City at the foot of Mt Apo

- 𝗗𝗮𝘃𝗮𝗼 𝗖𝗶𝘁𝘆 ↦ Durian Capital, Cacao Capital

- 𝗞𝗼𝗿𝗼𝗻𝗮𝗱𝗮𝗹 ↦ Ilonggo City of the South

- 𝗚𝗲𝗻𝗦𝗮𝗻 𝗖𝗶𝘁𝘆 ↦ Tuna Capital

- 𝗕𝘂𝗸𝗶𝗱𝗻𝗼𝗻 ↦ Pineapple Capital

- 𝗠𝗮𝗹𝗮𝘆𝗯𝗮𝗹𝗮𝘆 ↦ Summer Capital of the South

- 𝗗𝗮𝘃𝗮𝗼 ↦ Fruit Basket and King City of the South

- 𝗖𝗮𝗴𝗮𝘆𝗮𝗻 𝗱𝗲 𝗢𝗿𝗼 ↦ City of Golden Friendship

- 𝗜𝘀𝘂𝗹𝗮𝗻 ↦ Oil Palm Capital of the Philippines

- 𝗖𝗮𝗺𝗶𝗴𝘂𝗶𝗻 ↦ Island Born of Fire

- 𝗦𝗶𝘁𝗮𝗻𝗴𝗸𝗮𝗶, 𝗧𝗮𝘄𝗶 𝗧𝗮𝘄𝗶 ↦ Venice of the South

- 𝗖𝗼𝘁𝗮𝗯𝗮𝘁𝗼 ↦ Land of Mightiest Mountain

- 𝗟𝗮𝗻𝗮𝗼 𝗱𝗲𝗹 𝗦𝘂𝗿 ↦ Cradle of Muslim Art

- 𝗦𝗼𝘂𝘁𝗵 𝗖𝗼𝘁𝗮𝗯𝗮𝘁𝗼 ↦ Conference Capital of Mindanao

- 𝗗𝗶𝗻𝗮𝗴𝗮𝘁 𝗜𝘀𝗹𝗮𝗻𝗱 ↦ Mystical Province of Love

- 𝗦𝘂𝗿𝗶𝗴𝗮𝗼 𝗱𝗲𝗹 𝗡𝗼𝗿𝘁𝗲 ↦ Surfing Capital

- 𝗟𝗮𝗻𝗮𝗼 𝗱𝗲𝗹 𝗡𝗼𝗿𝘁𝗲 ↦ Land of Beauty and Bounty

- 𝗢𝗿𝗼𝗾𝘂𝗶𝗲𝘁𝗮 ↦ City of Good Life

- 𝗭𝗮𝗺𝗯𝗼𝗮𝗻𝗴𝗮 𝗱𝗲𝗹 𝗡𝗼𝗿𝘁𝗲 ↦ Province of South’s Twin City

- 𝗠𝗮𝗴𝘂𝗶𝗻𝗱𝗮𝗻𝗮𝗼 ↦ Seat of Muslim Mindanao

- 𝗠𝗶𝘀𝗮𝗺𝗶𝘀 𝗢𝗰𝗰 ↦ Christmas Capital of Mindanao

- 𝗔𝗴𝘂𝘀𝗮𝗻 𝗱𝗲𝗹 𝗡𝗼𝗿𝘁𝗲 ↦ Land of Antiquated Finds

- 𝗕𝘂𝘁𝘂𝗮𝗻 ↦ Timber City of the South

- 𝗚𝗶𝗻𝗴𝗼𝗼𝗴 ↦ City of Good Luck

- 𝗗𝗮𝗽𝗶𝘁𝗮𝗻 ↦ Shrine and Historic City of the South

- 𝗣𝗮𝗴𝗮𝗱𝗶𝗮𝗻 ↦ Little Hong Kong of the South

- 𝗭𝗮𝗺𝗯𝗼𝗮𝗻𝗴𝗮 𝗖𝗶𝘁𝘆 ↦ Asias Latin City, Sardines Capital, City of Flowers

- 𝗦𝘂𝗹𝘂 ↦ Land of Exotic Fruits

- 𝗜𝗹𝗶𝗴𝗮𝗻 ↦ industrial City of the South

- 𝗗𝗶𝗽𝗼𝗹𝗼𝗴 ↦ The Phil. Orchid City

- 𝗟𝗮𝗻𝘁𝗮𝗽𝗮𝗻, 𝗕𝘂𝗸𝗶𝗱𝗻𝗼𝗻 ↦ Vegetable Basket of Mindanao

- 𝗔𝗸𝗹𝗮𝗻 ↦ Oldest province in the Philippines

- 𝗔𝗻𝘁𝗶𝗾𝘂𝗲 ↦ Province where the mountain meets the sea

- 𝗔𝗻𝘁𝗶𝗽𝗼𝗹𝗼 ↦ City in the Sky

- 𝗔𝘂𝗿𝗼𝗿𝗮 ↦ Land of Golden Sunrise

- 𝗔𝗹𝗶𝗺𝗼𝗱𝗶𝗮𝗻, 𝗜𝗹𝗼𝗶𝗹𝗼 ↦ Banana Capital of Panay

- 𝗕𝗮𝗰𝗼𝗼𝗿 ↦ Band Capital of the Philippines

- 𝗕𝗮𝗴𝘂𝗶𝗼 𝗖𝗶𝘁𝘆 ↦ Summer Capital/ City of Pines

- 𝗕𝗮𝘁𝗮𝗮𝗻 ↦ History Hub of Central Luzon

- 𝗕𝗮𝘁𝗮𝗻𝗴𝗮𝘀 ↦ Diving and Shipping Capital

- 𝗕𝗮𝘁𝗮𝗻𝗲𝘀 ↦ Land of True Insulars

- 𝗕𝗮𝗰𝗼𝗹𝗼𝗱 ↦ City of Smiles

- 𝗕𝗶𝗹𝗶𝗿𝗮𝗻 ↦ Shipyard of Antiquity

- 𝗕𝗲𝗻𝗴𝘂𝗲𝘁 ↦ Salad Bowl of the Philippines

- 𝗕𝗼𝗿𝗼𝗻𝗴𝗮𝗻 ↦ King City of the East

- 𝗕𝗼𝗵𝗼𝗹 ↦ Calamay Capital of the Philippines

- 𝗕𝘂𝗹𝗮𝗰𝗮𝗻 ↦ Manila’s Gateway to the North

- 𝗖𝗮𝗹𝗯𝗮𝘆𝗼𝗴 ↦ City of Waterfalls

- 𝗖𝗮𝗶𝗻𝘁𝗮, 𝗥𝗶𝘇𝗮𝗹 ↦ Bibingka Capital

- 𝗖𝗮𝗹𝗮𝗺𝗯𝗮 ↦ Hot Spring Capital

- 𝗖𝗮𝗺 𝗦𝘂𝗿 ↦ Wakeboarding Capital

- 𝗖𝗮𝘃𝗶𝘁𝗲 ↦ Cradle of Phil. Revolution

- 𝗖𝗮𝘁𝗯𝗮𝗹𝗼𝗴𝗮𝗻 ↦ City of Captivating Contrast

- 𝗖𝗮𝘁𝗮𝗻𝗱𝘂𝗮𝗻𝗲𝘀 ↦ Land of the Howling Wind

- 𝗖𝗮𝘂𝗮𝘆𝗮𝗻, 𝗜𝘀𝗮𝗯𝗲𝗹𝗮 ↦ Mushroom City of the North

- 𝗖𝗲𝗯𝘂 ↦ Gateway to a Thousand Journeys

- 𝗗𝘂𝗺𝗮𝗴𝘂𝗲𝘁𝗲 ↦ City of Gentle People

- 𝗗𝗮𝗴𝘂𝗽𝗮𝗻 ↦ Bangus Capital

- 𝗗𝗼𝗻𝘀𝗼𝗹, 𝗦𝗼𝗿𝘀𝗼𝗴𝗼𝗻 ↦ World’s Whale Shark Capital

- 𝗘𝗮𝘀𝘁𝗲𝗿𝗻 𝗦𝗮𝗺𝗮𝗿 ↦ Gateway to Phil. Discovery

- 𝗘𝗹 𝗦𝗮𝗹𝘃𝗮𝗱𝗼𝗿, 𝗠𝗶𝘀 𝗢𝗿 ↦ City of Divine Mercy

- 𝗘𝗹 𝗡𝗶𝗱𝗼 ↦ Heaven on Earth

- 𝗚𝘂𝗶𝗺𝗮𝗿𝗮𝘀 ↦ Mango County of Visayas

- 𝗚𝘂𝘁𝗮𝗹𝗮𝗰, 𝗭𝗮𝗺𝗯. 𝗡𝗼𝗿𝘁𝗲 ↦ Pebble Capital

- 𝗜𝗹𝗼𝗶𝗹𝗼 ↦ Province with most number of barangays

- 𝗜𝗹𝗼𝗶𝗹𝗼 𝗖𝗶𝘁𝘆 ↦ The First Queen City of the South, City where the Past is always present

- 𝗜𝗹𝗼𝗰𝗼𝘀 𝗦𝘂𝗿 ↦ Heritage Haven of the Far North

- 𝗜𝗺𝘂𝘀 ↦ The Philippine Flag Capital

- 𝗜𝘀𝗮𝗯𝗲𝗹𝗮 ↦ Rice Granary of the North

- 𝗞𝗮𝗹𝗶𝗻𝗴𝗮 ↦ White Rafting Capital of the North

- 𝗟𝗮 𝗨𝗻𝗶𝗼𝗻 ↦ Surfing Capital of the North

- 𝗟𝗮𝗴𝘂𝗻𝗮 ↦ The Silicon Valley

- 𝗟𝗮 𝗧𝗿𝗶𝗻𝗶𝗱𝗮𝗱, 𝗕𝗲𝗻𝗴𝘂𝗲𝘁 ↦ Strawberry Capital

- 𝗟𝗮𝘀 𝗣𝗶𝗻𝗮𝘀 ↦ Salt Center of Metro Manila

- 𝗟𝗲𝗴𝗮𝘇𝗽𝗶 ↦ City of Fun and Adventure, ATV capital

- 𝗟𝗶𝗽𝗮, 𝗕𝗮𝘁𝗮𝗻𝗴𝗮𝘀 ↦ City of Pride

- 𝗟𝗶𝗻𝗴𝗮𝘆𝗲𝗻 ↦ The Most Romantic Place

- 𝗟𝘂𝗰𝗲𝗻𝗮, 𝗤𝘂𝗲𝘇𝗼𝗻 ↦ Biofuel & Biopalm City

- 𝗠𝗮𝗮𝘀𝗶𝗻 𝗖𝗶𝘁𝘆, 𝗦. 𝗟𝗲𝘆𝘁𝗲 ↦ The Religious City

- 𝗠𝗮𝗸𝗮𝘁𝗶 ↦ Manhattan of the Philippines

- 𝗠𝗮𝗿𝗶𝗸𝗶𝗻𝗮 ↦ Shoe Capital of the Philippines

- 𝗠𝗮𝘀𝗯𝗮𝘁𝗲 ↦ Great Wild West of Phil.

- 𝗠𝗮𝗻𝗶𝗹𝗮 ↦ Ever Distinguished Loyal City

- 𝗠𝗮𝗿𝗶𝗻𝗱𝘂𝗾𝘂𝗲 ↦ Heart of the Philippines

- 𝗠𝗮𝗻𝗱𝗮𝘂𝗲 ↦ Furniture Capital

- 𝗠𝗮𝗻𝗱𝘂𝗹𝘂𝘆𝗼𝗻𝗴 ↦ Shopping Capital

- 𝗠𝗶𝗮𝗴𝗮𝗼, 𝗜𝗹𝗼𝗶𝗹𝗼 ↦ Municipality with most number of barangays, Onion Capital of Visayas

- 𝗠𝗼𝗹𝗼, 𝗜𝗹𝗼𝗶𝗹𝗼 ↦ Athens of the Philippines

- 𝗠𝘂𝗻𝘁𝗶𝗻𝗹𝘂𝗽𝗮 ↦ The Emerald City

- 𝗡𝗮𝗴𝗮 ↦ Bicols Queen City

- 𝗡𝗮𝘃𝗼𝘁𝗮𝘀 ↦ Fishing Capital of Greater Manila

- 𝗡𝗲𝗴𝗿𝗼𝘀 𝗢𝗰𝗰𝗶𝗱𝗲𝗻𝘁𝗮𝗹 ↦ Sugar Bowl

- 𝗡𝗲𝗴𝗿𝗼𝘀 𝗢𝗰𝗰𝗶𝗱𝗲𝗻𝘁𝗮𝗹 ↦ Province with most number of cities

- 𝗡𝗲𝗴. 𝗢𝗿𝗶𝗲𝗻𝘁𝗮𝗹 ↦ Whale and Dolphin Haven

- 𝗡𝘂𝗲𝘃𝗮 𝗘𝗰𝗶𝗷𝗮 ↦ Rice Granary of the Philippines

- 𝗡𝘂𝗲𝘃𝗮 𝗩𝗶𝘇𝗰𝗮𝘆𝗮 ↦ Watershed Haven of Cagayan Valley

- 𝗢𝗿𝗶𝗲𝗻𝘁𝗮𝗹 𝗠𝗶𝗻𝗱𝗼𝗿𝗼 ↦ Harbor Gateway to the South

- 𝗣𝗮𝗹𝗮𝘄𝗮𝗻 ↦ Largest Province in the Philippines

- 𝗣𝗮𝗹𝗮𝘄𝗮𝗻 ↦ Philippines’ Last Frontier

- 𝗣𝗮𝗺𝗽𝗮𝗻𝗴𝗮 ↦ Culinary Capital of the Philippines

- 𝗣𝗮𝗻𝗴𝗮𝘀𝗶𝗻𝗮𝗻 ↦ Saltmaking Capital

- 𝗣𝗮𝘁𝗲𝗿𝗼𝘀 ↦ Balut Capital

- 𝗣𝗮𝗿𝗮𝗻𝗮𝗾𝘂𝗲 ↦ Fashion Capital

- 𝗣𝗮𝘀𝗮𝘆 ↦ Travel Capital

- 𝗣𝗮𝘀𝘀𝗶 ↦ Sweet City at the Heart of Panay

- 𝗣𝗼𝘁𝗼𝘁𝗮𝗻, 𝗜𝗹𝗼𝗶𝗹𝗼 ↦ Christmas Capital of Visayas

- 𝗣𝘂𝗲𝗿𝘁𝗼 𝗚𝗮𝗹𝗲𝗿𝗮 ↦ Mini Boracay

- 𝗣𝘂𝗲𝗿𝘁𝗼 𝗣𝗿𝗶𝗻𝗰𝗲𝘀𝗮 ↦ EcoTourism Capital

- 𝗤𝘂𝗲𝘇𝗼𝗻 𝗖𝗶𝘁𝘆 ↦ City of Stars and New Horizons

- 𝗤𝘂𝗶𝗿𝗶𝗻𝗼 ↦ Forest Heartland of Cagayan Valley

- 𝗥𝗶𝘇𝗮𝗹 ↦ Cradle of Philippine Arts

- 𝗥𝗼𝗺𝗯𝗹𝗼𝗻 ↦ Marble Capital

- 𝗥𝗼𝘅𝗮𝘀 𝗖𝗶𝘁𝘆 ↦ Seafood Capital of the Philippines

- 𝗦𝗮𝗯𝗹𝗮𝘆𝗮𝗻, 𝗢𝗰𝗰. 𝗠𝗶𝗻𝗱𝗼𝗿𝗼 ↦ Largest Municipality in the Philippines

- 𝗦𝗮𝗺𝗮𝗿 ↦ Spelunking Capital

- 𝗦𝗮𝗻 𝗝𝘂𝗮𝗻 ↦ Tiangge Capital

- 𝗦𝗮𝗻 𝗙𝗲𝗿𝗻𝗮𝗻𝗱𝗼 ↦ Lantern Capital

- 𝗦𝗶𝗾𝘂𝗶𝗷𝗼𝗿 ↦ Island of Fire

- 𝗧𝗮𝗿𝗹𝗮𝗰 ↦ Melting Pot of Central Luzon

- 𝗧𝗮𝗰𝗹𝗼𝗯𝗮𝗻 𝗖𝗶𝘁𝘆 ↦ City of Hope

- 𝗧𝗮𝗴𝗯𝗶𝗹𝗮𝗿𝗮𝗻 ↦ City of Peace and Friendship

- 𝗧𝗮𝗴𝘂𝗶𝗴 ↦ The ProvinSyudad

- 𝗧𝘂𝗴𝘂𝗲𝗴𝗮𝗿𝗮𝗼 ↦ Premier Ybanag City

- 𝗩𝗮𝗹𝗲𝗻𝘇𝘂𝗲𝗹𝗮 ↦ The Only Divided City

- 𝗩𝗮𝗹𝗲𝗻𝘇𝘂𝗲𝗹𝗮 ↦ Vibrant City of Discipline

- 𝗭𝗮𝗺𝗯𝗮𝗹𝗲𝘀↦ Chromite Capital

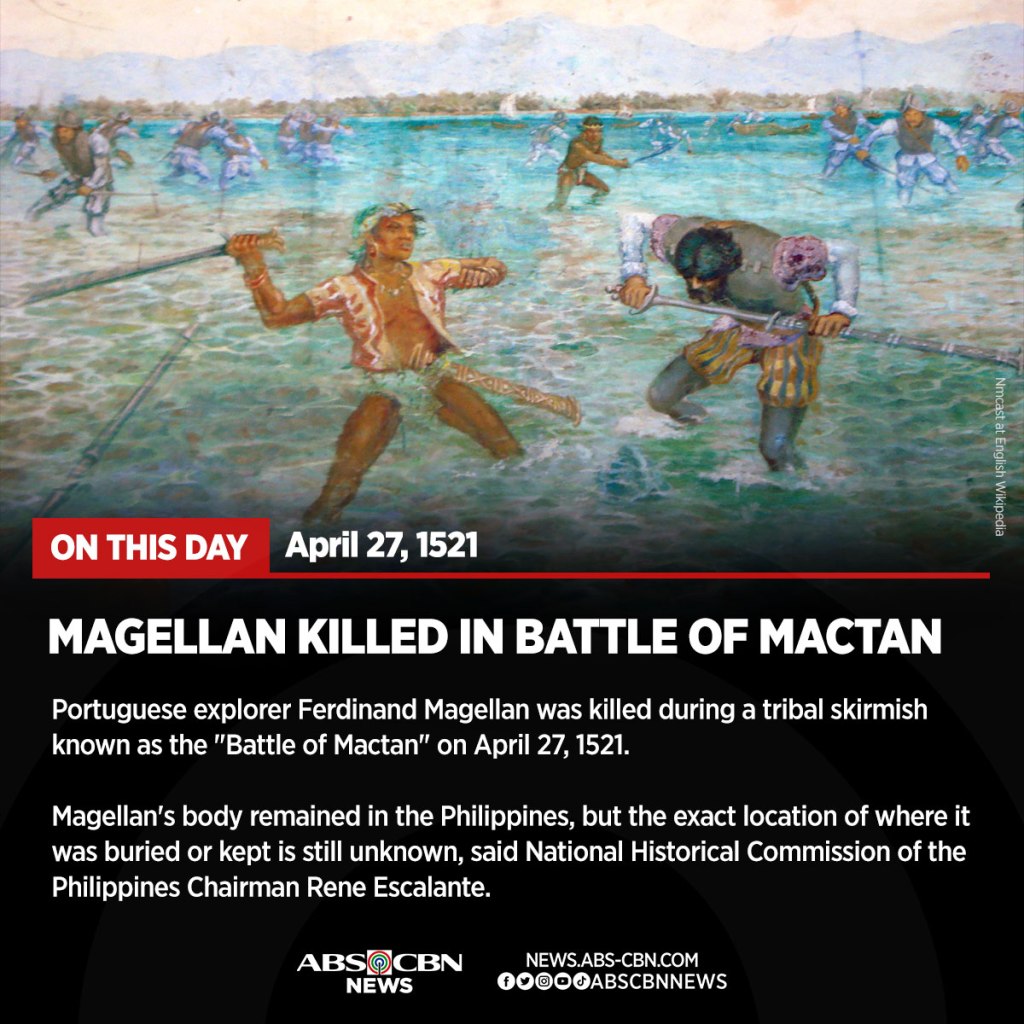

MAGELLAN KILLED IN A BATTLE IN MACTAN

Ferdinand Magellan was a Portuguese navigator who is best known for leading the first successful circumnavigation of the world. He embarked on this expedition in 1519 with a fleet of five ships, and after three years of sailing, one of the ships, the Victoria, completed the journey in 1522. Back to homepage

However, during the course of his journey, Magellan was killed in a battle in Mactan, which is located in the Philippines. On April 27, 1521, Magellan and his crew arrived in the Philippines, where they encountered the local ruler, Lapu-Lapu. Magellan attempted to subdue Lapu-Lapu and his people, but he was met with fierce resistance. In the ensuing battle, Magellan was killed, and his body was never recovered.

Despite his untimely death, Magellan’s expedition remains a significant achievement in the history of exploration, as it proved that the Earth was indeed round and opened up new trade routes that connected Europe, Asia, and the Americas.

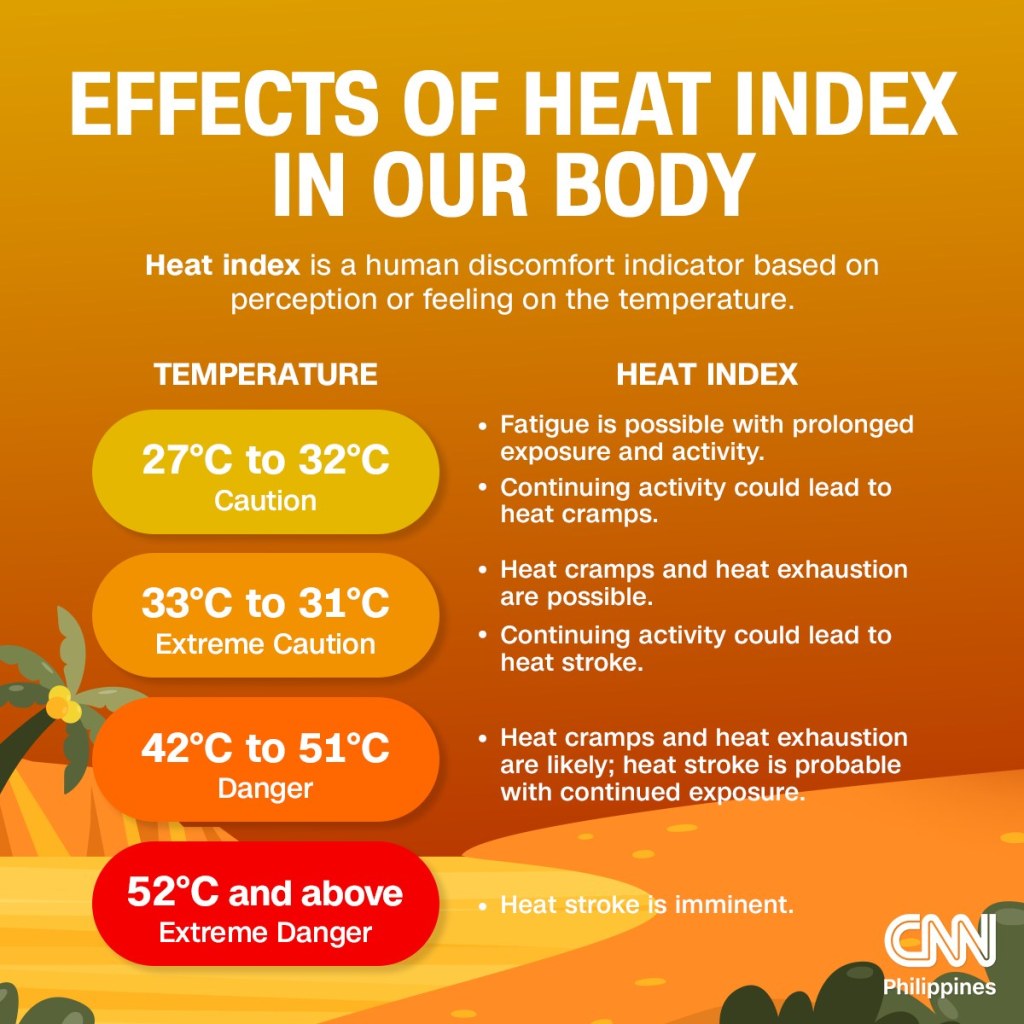

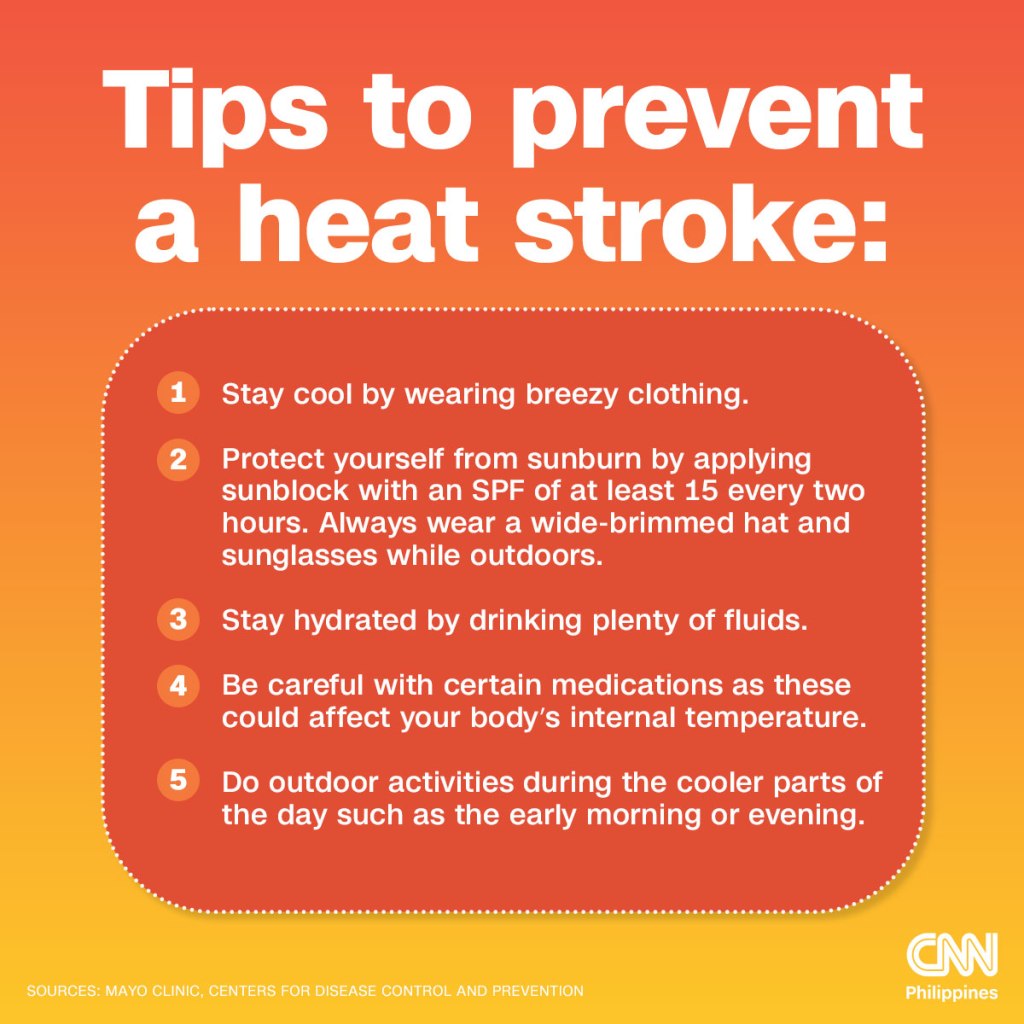

HEAT IN THE COUNTRY REACHED DANGEROUS LEVELS

The heat reached dangerous levels in many locations around the country on April 22 (Saturday) and is expected to maintain scorching temperatures into next week, the state weather bureau warned.

The state weather bureau issued a warning about the dangerous levels of heat that were reached in many locations around the country on April 22 (Saturday), cautioning the public to take necessary precautions to avoid heat-related illnesses and discomfort. The high temperatures, which are expected to persist into next week, could pose significant health risks, particularly to vulnerable populations such as the elderly, young children, and individuals with pre-existing medical conditions. The scorching temperatures could also exacerbate drought conditions, increase the risk of wildfires, and put a strain on energy resources as people turn to air conditioning to cope with the heat. It is therefore important for people to stay hydrated, stay indoors during the hottest parts of the day, wear loose-fitting and light-colored clothing, and avoid strenuous activities to minimize their risk of heat-related illnesses.

The No. 1 question you should ‘always’ ask at job interviews—it can get you hired ‘on the spot,’ says expert

Published Wed, Apr 19 202310:39 AM EDTUpdated Wed, Apr 19 20231:08 PM EDT | Natalie Fisher

Preparing for a job interview is tricky. As a career coach who has helped hundreds of people land six-figure salaries, I’ve found one of the biggest mistakes candidates make is failing to ask strong questions.

Instead, they obsess over giving the right answers. But you don’t want to be the person who freezes when the hiring manager pauses at the end of the meeting and says, “Do you have any questions for me?”

There’s one question in particular that I tell people to always ask at job interviews (some have even told me it helped them land an offer on the spot): “If the new hire was to achieve one thing that would blow your mind, what would it be?”

It shows that you are strategic and think ahead

With this question, you’re telling your potential employer that you don’t just do the bare minimum, but that you plan to go above and beyond.

Plus, it makes you seem confident enough to use fun, playful language. Too many people stray away from showing personality in an interview.

Sometimes the hiring manager won’t know how to answer this question, so it creates space to discuss and envision what could be possible together if you were hired.

How to make the most out of this question

Typically, the hiring manager will respond with a smile, think for a minute, then answer with their current goals and how the ideal candidate would perform (or over-perform).

To respond, share how you’ve reached a similar goal in the past. For example, the hiring manager tells you: “It would blow my mind if, within six months, the candidate we hire sold our product at 100% of their quota.”

If you have experience performing at that quota, you could say: “I’ve done just that! Within six months of starting my current job, I hit 150% of the company’s trainee quota.”

If you haven’t reached such a lofty goal, respond with follow-up questions that show your enthusiasm for delivering on it. In the example above, you could ask if anyone on their team has achieved it, and what made them so successful.

Then explain why you have what it takes: “It sounds like building relationships in new sectors has been key for your top sales performers. I’ve been doing this at [X and Y companies] in [X underrepresented sector] in the past five years. I’m confident that I can bring them here as clients.”

How to spot the red flags

You can learn a lot by how the hiring manager responds, too. If they react negatively to this question, it could mean they are not receptive to you thinking creatively. It may be a “sit down and shut up” environment with limited room for growth.

If they come up with unrealistic goals, it may be an environment that asks too much of its employees, or has a poor work-life balance.

Remember, it’s not just the employer analyzing whether or not you’re a good fit for the role. You also need to ask yourself: “Will I be happy at this company?”

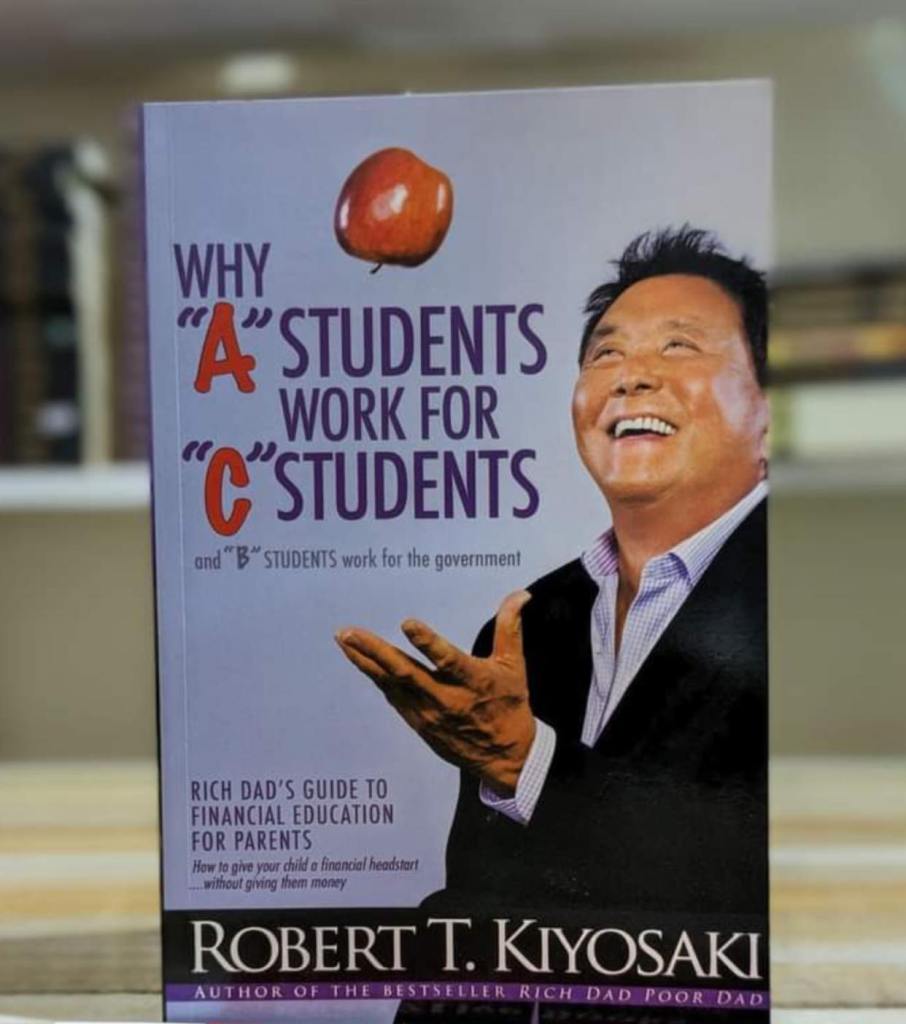

WHY A STUDENTS WORK FOR C STUDENTS?

Notable quotes and lessons from the book Why A Students Work For C Students by Robert Kiyosaki

1. The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems like an instant.

2. If you want to be rich, you need to develop your vision. You must be standing on the edge of time gazing into the future.

3. The most successful people in life are the ones who ask questions. They’re always learning. They’re always growing. They’re always pushing.

4. If you’re the kind of person who has no guts, you just give up every time life pushes you. If you’re that kind of person, you’ll live all your life playing it safe, doing the right things, saving yourself for some event that never happens. Then, you die a boring old man.

5. The size of your success is measured by the strength of your desire; the size of your dream; and how you handle disappointment along the way.

6. If you want to go somewhere, it is best to find someone who has already been there.

7. The most successful people are those who are good at plan B.

In the book Robert kiyosaki challenges the traditional approach to education and encourages readers to think differently about success and financial independence.

Here are few lessons to learn![]()

1. The importance of financial education:

The book stresses the importance of financial education and how it can help individuals achieve financial independence. Kiyosaki argues that traditional education does not provide enough practical knowledge about money management and investing.

2. The value of entrepreneurship:

The book encourages readers to consider entrepreneurship as a path to financial success. Kiyosaki argues that owning a business provides more opportunities for wealth creation than working for someone else.

3. The dangers of conformity:

The book highlights the dangers of conformity and how it can limit individual potential. Kiyosaki argues that traditional education encourages conformity and discourages creativity and independent thinking.

4. The power of networking:

The book emphasizes the importance of networking and building relationships. Kiyosaki argues that networking can help individuals find new opportunities and connect with successful people who can provide mentorship and guidance.

5. The importance of taking risks:

The book encourages readers to take calculated risks in order to achieve their goals. Kiyosaki argues that playing it safe and avoiding risk can lead to missed opportunities and limited success.

6. The value of resilience:

The book emphasizes the importance of resilience and perseverance in the face of failure. Kiyosaki argues that failure is an essential part of the learning process and that successful people are those who can bounce back from setbacks.

7. The need to constantly learn and grow:

The book stresses the importance of lifelong learning and personal development. Kiyosaki argues that successful people are always seeking new knowledge and skills to improve themselves and their businesses.

IS IT A WISE INVESTMENT?

Here are 4 reasons why WE should invest in pre-selling homes:

1. Affordable

Pre-selling units are more affordable compared to the regular ready-for-occupancy homes. OFWs can save money because of the low introductory price. Pre-selling properties are usually 30 to 50% cheaper than a finished one. Developers even offer discounts, a reduced down payment rate, and flexible payment schemes. Whether it is a townhouse or a condo unit, OFWs will find it easier to fulfill the payment because of affordability.

2. Appreciation of Value

The value of a property that was initially sold as pre-sale appreciates over a period of time after its construction. More so, when the community where it belongs to prospers and becomes more developed, its value will further increase. However, OFWs should seriously consider the location for it significantly plays a role when it comes to the worth of a property.

3. Potential Income-Generator

OFWs can potentially generate income even when they are not in the country once the property is already finished. They can opt to rent it out. That way, there would be a constant source of income that would help them save more money. They can also sell the home once the construction is done and invest in another pre-selling property. This cycle when ingeniously established encourages a pattern that helps generate income effortlessly. It can be helpful for OFWs who no longer want to work overseas.

4. Security

A sense of security is felt by OFWs when they buy a property. Pre-selling homes also give that feeling of anticipation because of the waiting period that is always worth it. Gone are the days when it takes a lot of effort just to find the home that would best cater to the needs of homeseekers. Nowadays, everyone can just access the internet and search for homes or even ask real estate professionals. OFWs are a part of those homeseekers who want to own a home that would meet all of their needs.